The Manville Municipal Budget: A First Look

The Manville Municipal Budget: A First Look

By: Chris Basista

Published on May 7, 2024

At Monday's Council Meeting on May 6th, the budget was introduced for 2024. Chief Financial Officer Michael Pitts presented the Manville Municipal Budget. As this was the initial presentation, no questions were permitted from residents. However, public comment will be allowed during the next budget presentation scheduled for June 10th.

It's worth noting that by that time, we'll be halfway through the budget year, well past the deadline for submitting the budget to the state. Perhaps someone will raise this concern during the June 10th meeting.

Here are some key points from the budget presentation:

Increased Property Value: Manville's overall value has risen by 8.47% compared to 2023, now reaching an impressive $1,354,745,900. This increase is largely attributed to higher property assessments. The average assessed home value stands at $360,645, reflecting an 8.62% increase from the previous year.

Property Tax Rate and Municipal Taxes: The property tax rate has decreased by 5.98% to $0.743. However, this reduction doesn't guarantee that individual taxes won't increase. The focus during the presentation was solely on the municipal portion, as that falls under the Borough's control. The Mayor and CFO were quite pleased with themselves that despite "high inflation" and the "lack of aid we get", our municipal taxes are only increasing by 1.99%.

Assessments: Property assessment values are at the core of the tax rates. Without getting into complicated math formulas, you can have a tax rate "decrease" but still end up paying more in taxes, if your property assessment increased.

There is still a larger question of fairness in this process. When searching through random properties in Manville, there is still a disparity between similar properties having significantly different assessed values. This is also still true regarding commercial property. While it appears the tax rates are going down, in reality, residents are going to end up paying more.

Bond Rating: The presentation briefly touched on Manville's Moody's Rating, which is "A1". While Manville appears healthy from a financial standpoint, the rating can change at any time. Think of this like a credit score for the town.

One way Manville can improve their rating is to increase the tax base. One way Manville can harm their rating is a deterioration of the tax base.

Example: If the last large parcel of land was properly developed, this can increase the tax base and rating. If buyouts continue, and aren't replaced by new tax ratables, this could potentially harm Manville's rating.

Blaming the County: It's been a common theme at Borough Council meetings that the County gets blamed for increasing their side of our tax bill. This goes back to property assessments. The higher your home is assessed, you can potentially pay more in county taxes. Since Manville's assessment program has property values increasing year-over-year, it's to be expected that an increase could occur.

Schools: While the school budget is calling for the exact same tax levy as in the past several years, residents may still see an increase here, too. Why? This also goes back to property assessments. When the value of your home increases, your share of the school tax can potentially increase as well. The core problem that needs to be addressed is how Manville conducts property assessments. The process needs to be fairer.

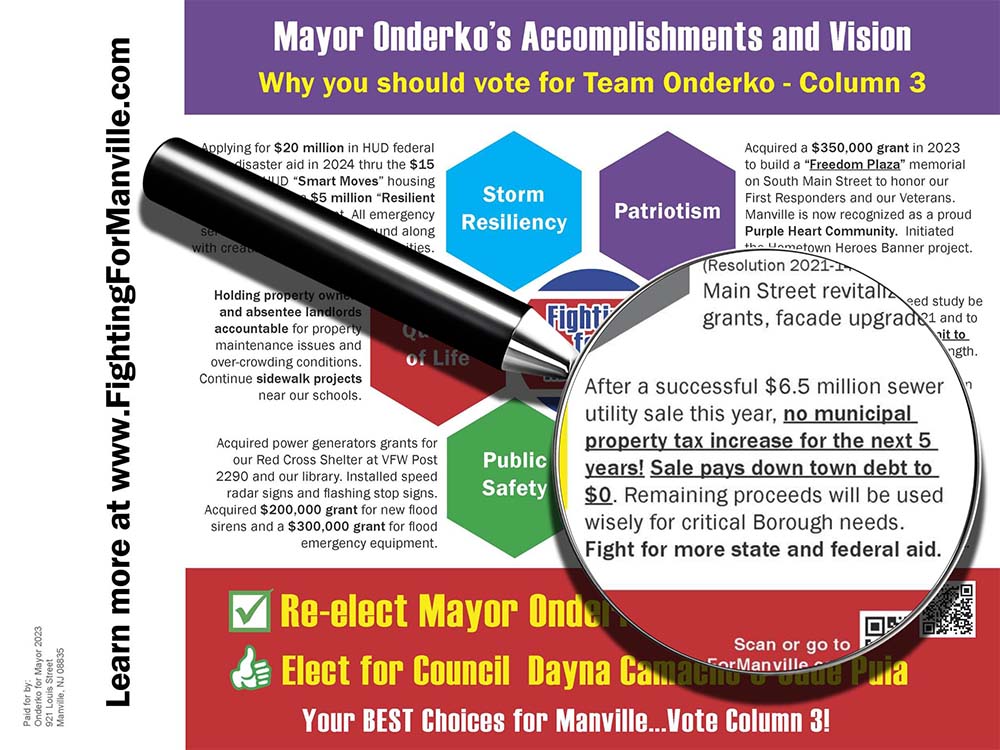

Election Promises and Accountability: Last year's election saw promises from Mayor Onderko, Ms. Puia, and Mrs. Camacho that municipal taxes would not increase if the sewer sale was approved.

Mayor Onderko's campaign mailer from 2023, stating "no municipal property tax increase for the next 5 years" (1)

Audio clip from the Sewer Sale presentation where Mayor Onderko reiterates no tax increases. (2)

However, the reality doesn't appear to align with those campaign pledges. This highlights the continued need for transparency and accountability.

Unanswered Questions: Screenshots taken during the presentation (because no copies were made available before or during the meeting) have left us with more questions than answers. Some of these include:

- How are we addressing the gap that led to the need for transitional aid?

- Despite a list of capital improvement projects, only $300,000 seems to be allocated. How are we planning for larger needs like vehicles or equipment? For example, we keep hearing the street sweeper needs to be repaired or replaced during recent meetings.

- What is the management plan for revenue generated from the sewer sale, especially after debt payments?

- What are the four unfunded ordinances totaling $1,352,460?

Fiscal Responsibility: Every taxpayer deserves clarity on how their money is being spent. While competitive salaries and benefits are essential, we must also explore revenue opportunities.

For instance, let's consider the only available tax revenue-generating property. Rather than converting it into a nice, new shiny office for the Mayor, we should weigh other options that will maximize tax revenue. Especially when more buyouts could be on the horizon.

For further insights, we encourage you to explore our 6-part series on the history and plans for Rustic Mall, starting on Thursday, May 9th.

1: Team Onderko Campaign Flyer, 2023

2: Audio clip from NJ American Water Public Hearing 9/18/2023 at Manville Public Library. Full video available here - https://www.facebook.com/watch/?v=1648643488964768&ref=sharing

More Stories

Frank's Pizza Unauthorized Credit Card Charges

Dec 04, 2025

Honoring and Remembering Councilman Steve Szabo

Nov 28, 2025

Borough Declines Rustic Mall Mediation

Nov 24, 2025